Why You Should Start Mining Ethereum Now Before It's Too Late

So apparently, only three years since the gruesome crash of 2018, cryptocurrencies are a thing again. I've gotten heavily disillusioned about them after the crash, and kind of expected everyone did, so I was surprised to see we're hyping about them again.

Why is that so? This time we're not talking about ICOs (most of which turned out to be scams), but DeFi and NFTs, which don't really seem like a big enough advancements to warrant this amount of excitement. What's it about then? No idea.

But apart from that, we also had COVID, which impacted the global supply lines, leading to shortages in consumer hardware, most notably with the release of PlayStation 5. And we've also witnessed the rise of scalping), pushing the prices of consumer hardware through the roof. All of that led to this interesting scenario:

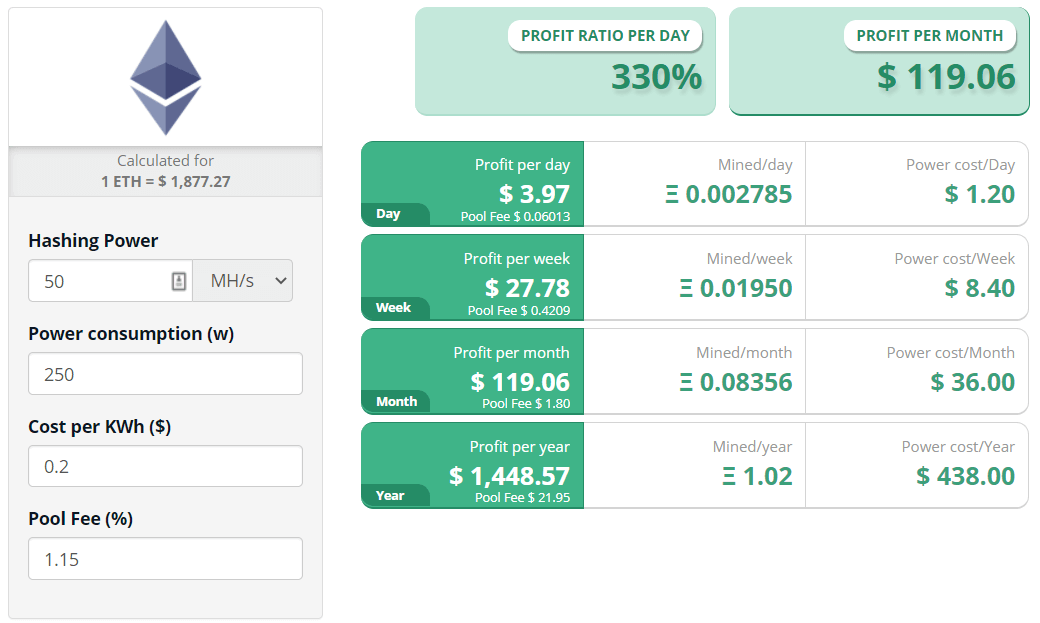

The graphics card that I got in July of 2020, which I got for a then-expensive price of $500 is now selling for $1100 on used market. Turns out it's, while not the most recent or powerful card on the market, one of the most efficient ones for mining Ethereum, netting you around $120 of profits monthly. And I didn't even know this until a friend told me last week.

Historically, I don't think it's ever been this profitable. And as I will explain in this post, it won't be for much longer, making this a prime time to start mining, while it's still possible.

Besides, as the old saying goes: "when in gold rush, sell shovels". With mining being this hype cycle's equivalent of selling shovels, let's jump in and try to exploit this unique situation, start mining and earn some money. Or at least, try to lose less of it than we did in 2018.

What is mining and why is it profitable now suddenly

In a traditional bank, it's the bank itself that verifies all transactions between people, writes them down, keeps track of it. Cryptocurrency nerds don't like having a singular entity responsible for that, so they're trying to solve it by distributing the trust to a bunch of disconnected computers around the world, and let them handle the bank's work. That's what miners are.

They are running a software on their computers that handles transactions on the network - when a person A sends money to person B, a bunch of miners are dispatched to verify it and write it down. The miners who manage to do that first get paid, collecting all the transaction fees.

As the process of "writing transactions down" is made to be computationally intensive on purpose, to prevent tampering with it, mining cryptocurrencies requires beefy hardware to run. This means having an either highly-specialized hardware which Bitcoin miners use, or just regular consumer-available (but not right now) GPUs for Ethereum.

If there's too many miners in the system, each of them gets a smaller percentage of the total fees. If there's too few, each gets a bigger one. This system is self-balancing: if the miners' earnings are low, some of them will leave, improving the earnings of the ones that remain. If earnings are good, it will prompt more miners to join, proportionally decreasing the earnings of all other miners, ideally keeping everything balanced.

However... Due to GPU shortages, new miners can't join, throwing the system out of equilibrium, making existing miners' earnings shooting through the roof.

This is further improved, at least for miners, by the demand (measured in number of daily transactions) for many cryptocurrencies currently being at an all-time high, so miners are needed, but there's just not enough hardware in the world for it. Kind of an interesting thought.

But that's not all. Ethereum, on which we'll be focusing in this article, has a certain "design flaw" regarding transaction fees - they're often unpredictable and most of the users end up overpaying them, especially in times of higher demand like now. Which also, you guessed it, improves miners' profits. More on this later.

To sum it up - mining on RX 5700 XT in March of 2021 will profit you around $120 per month, making it a pretty sweet deal for doing nothing.

We're in a pretty specific situation here, and this most likely won't last. More about why in the next section.

EIP-1559 and why it might be a good idea to start mining while you still can

On Ethereum, when you're sending money to someone, you set the transaction fee. Setting a bigger one makes miners notice you faster and process your transaction before someone who's set a smaller amount. This works fine generally, but in a high-demand market, most of the users end up overpaying the fees just to get their transaction done in a reasonable time.

To fix this, Ethereum team has a proposal ready - EIP-1559.

With this change, once it's deployed, fees are gonna become more consistent for the users, which will come at the expense of miners. What sounds even scarier, at least for miners, is that the majority of all transaction fees will get... burned forever.

Huh, what? Yep, this is apparently a valid strategy that some other cryptocurrencies use to keep their coin "deflationary". Basically, if the coins are destroyed, then all the rest are worth more, simply because there's less of them. The implications of it are, at least for EIP-1559, interesting:

In the current setup, miners are the ones who are profiting from "network effects" - if Ethereum platform is flourishing, miners earn more money, but the users don't get any benefit. If anything, they are disadvantaged as they have to pay more to get their transactions processed.

EIP-1559 sways the balance back to the users - as every transaction reduces the amount of money in the system, it means it also increases the value of money left in it. Having more transactions in the network increases the value of its users' holdings. I'm not that well-versed in finance, but it seems like a really smart solution to the problem. Here's an article which explains it much more eloquently.

Obviously, miners are outraged with this change as it will slash their profits significantly. EIP-1559 is apparently due to be deployed in a few months, and when it does, mining won't be as profitable as it is now.

And as a bonus punch in the face, probably in a year or so, Ethereum is slated to switch from existing mining-based "Proof of work" to the new "Proof of stake" mechanism, which will eliminate mining completely.

Which brings us to the point of this article - if you have a modern GPU you're not using, you might look into mining while it's still possible and this profitable. Setting it up in 2021. is pretty simple, I've written a separate post on how I did it on RX 5700 XT, and it's performing as expected, generating around $6 daily from $0.80 of electricity.

Interesting times ahead

I can't believe cryptocurrency has sucked me in again, I honestly thought I've seen it all in 2017. But here we are.

Whatever comes of EIP-1559 or transition to "Proof of Stake", the next few months may be interesting in Ethereum world. Might be a good idea to invest if/when it becomes "deflationary", as that sounds like it would make sense. Not an investment advice though.